As part of its ongoing coverage series with Twimbit, Telecom Review seeks to provide useful insights into the trends that are driving the growth of 5G in China and how these trends will continue to boost 5G in the country in the coming years.

Indeed, China has been at the forefront of the 5G revolution since its launch. The country has embraced this cutting-edge technology and set ambitious targets to advance economic digitization through its implementation, quickly attaining a remarkable presence in over 350 locations.

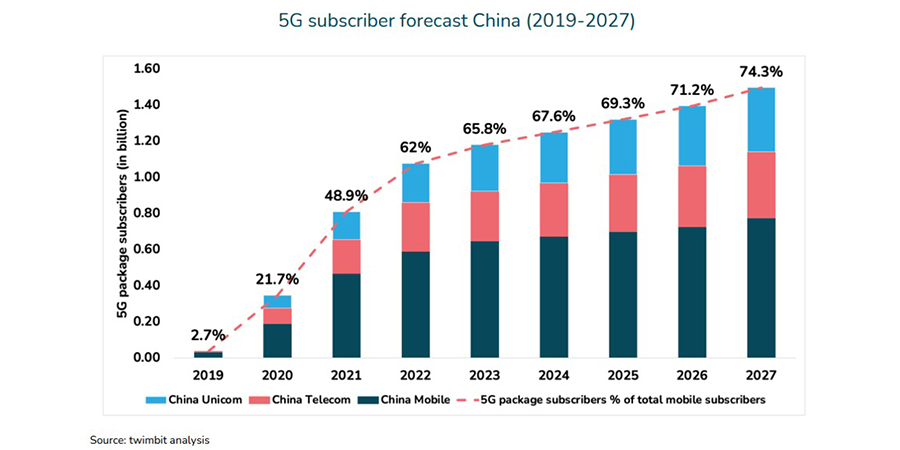

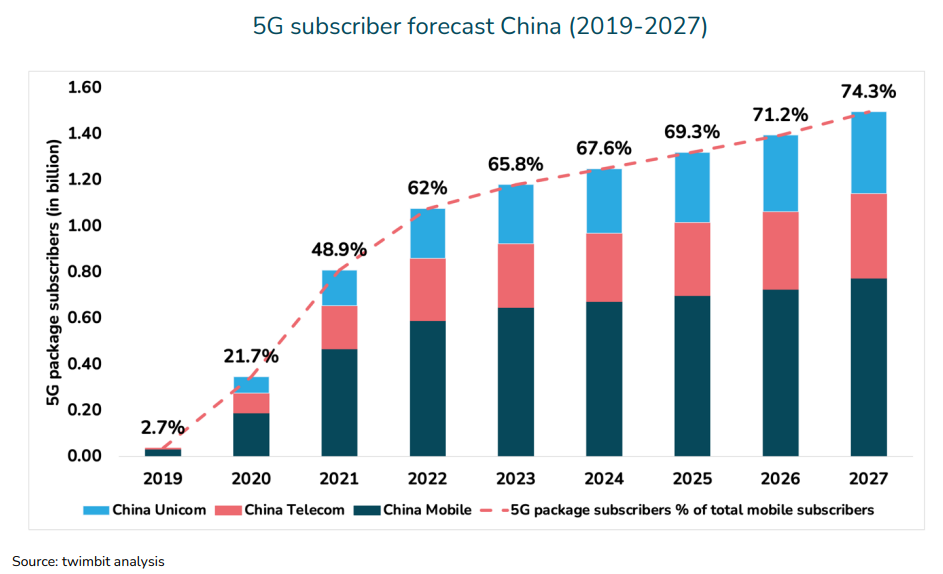

The extraordinary growth of 5G package subscribers has been one of the most notable successes of China's 5G journey. The term "5G Package Subscriber" refers to the overall number of 5G customers; this includes individuals who were previously subscribed to 4G plans but have now switched to 5G. This subscriber base is expected to increase from 1.07 billion in 2022 to a stunning 1.49 billion by 2027, surpassing all original projections.

According to Twimbit, 5G package subscribers in China have reached 65% and are expected to grow further to 74.3% in 2027. The surge in 5G adoption highlights the rapid evolution of China's digital landscape as well as customer demands for cutting-edge connectivity options.

Furthermore, the widespread adoption of 5G has resulted in a significant increase in data usage among consumers. In 2022, China Mobile users consumed an average of 21.2 GB of data, while China Telecom users consumed slightly more, at 24.1 GB. This can likely be attributed to the rising popularity of immersive experiences such as live streaming.

Challenges and Impacts of 5G Deployment

While 5G adoption in China appears to be thriving, it is not without some bumps in the road. On October 31, 2022, China completed three years of commercial availability with its 5G launch, a significant motivation for the industry worldwide. However, the impact of pervasive global logistics issues and a shortage of microchips, compounded by the COVID-19 pandemic, has been a barrier to network infrastructure deployments.

Additionally, Chinese telco firms have had to deal with higher capital expenditures (CAPEX), which increased to a considerable $58.3 billion in 2022, a 12% rise over the previous year. This increase was largely due to greater technology expenditures as well as the necessity for an increase in new base stations to cater to the rise of higher-frequency radio waves.

Despite these challenges, the overall impact of 5G on China's GDP is expected to be significant. Collectively, 5G applications in a variety of areas, including smart utilities, healthcare, manufacturing, financial services, consumer apps and media, are expected to contribute $220 billion to the Chinese economy by 2030.

Also Read: What China’s Five-Year Plan Means for Local and Overseas Tech Firms

Market Forecasts and Trends

Twimbit analysis shows that in 2020, China recorded 119 mobile cellular connections per 100 people, exceeding the global average of 106. Future projections appear to be even more optimistic, estimating 125 cellular connections for every 100 people by 2030. This demonstrates China’s consistent commitment to growing its digital infrastructure and ensuring widespread mobile access for its citizens.

Furthermore, China's 5G package subscriber base had reached a noteworthy penetration rate of 59% as of Q3 2022; in context, China had previously accomplished similar feats with its 4G users. Between 2013 and 2015, the country's adoption of 4G increased from 48% to a similarly distinguished 70%.

Also Read: China Mobile to Support Data Interconnect and Future 5G Services

Trends in ARPU

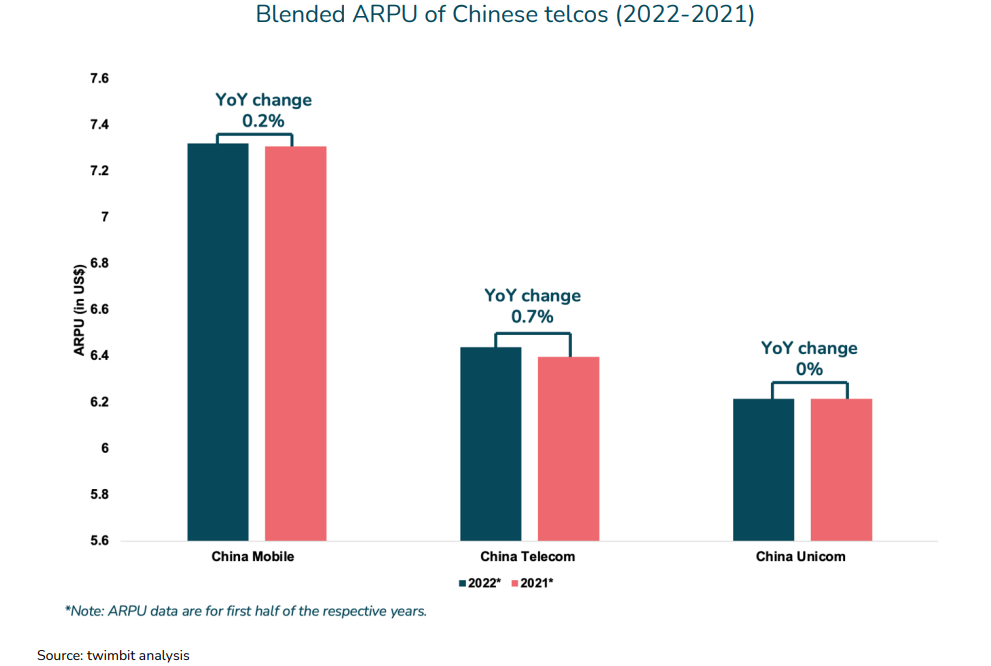

Chinese telcos have seen considerable effects on their average revenue per user (ARPU) as the country's 5G package subscribers expand. Here are some key insights on how 5G subscribers have affected ARPU:

- Chinese telcos witnessed a stabilization in blended ARPU due to the large-scale penetration of 5G.

- China Telecom’s 5G ARPU (US$7.4) is 15% higher, while China Mobile’s 5G ARPU (US$10) is 37% higher than the blended ARPU.

- China Mobile’s 5G ARPU decreased by 19.5% from the previous year, while China Telecom reported a decline of 8.2% in 5G ARPU.

- The base plan subscription for 5G gained popularity among subscribers, which increased blended ARPU but decreased 5G ARPU over the years.

Top Consumer Use Cases of 5G

Innovative use cases involving the rapid deployment of 5G have steadily evolved in China, where 5G has been rapidly deployed, augmenting the way consumers experience live events and engage with virtual reality.

With the capability of 5G, live streaming has taken a significant leap forward, enabling viewers to have more immersive and truly flawless experiences. China Unicom, in collaboration with Huawei, proudly demonstrated the latest potential of 5G at the 2022 Winter Olympics held in Beijing.

In this instance, China Unicom committed more than RMB 1.5 billion (roughly US$228.58 million) to developing and constructing 5G-powered internet for the Winter Olympics to offer an unsurpassed live streaming experience. This substantial investment paid dividends, as live streaming grew into a more realistic and enveloping experience for consumers.

Also Read: China Unicom, Huawei Launch New 5G Service to Enhance User Experience

Similarly, China Mobile, China Telecom and China Unicom have teamed up with Qualcomm to initiate 5G to deliver virtual experiences via Extended Reality (XR).

The emergence of vast 5G networks has enabled a wide range of devices to connect to the cloud, accelerating the expansion of the linked intelligent edge and cloud economy. Consumers may now enjoy virtual experiences like never before, thanks to the convergence of 5G and the Internet of Things (IoT).

Virtual reality (VR), augmented reality (AR) and mixed reality (MR) are all subgroups of extended reality that provide consumers with immersive and engaging experiences. The fast data transmission speeds and low latency of 5G play an important role in creating real-time, responsive XR experiences.

Also Read: IoT’s Impact on the Telecommunications Sector

The results of the report show that China's mobile connectivity journey from 4G to 5G demonstrates the country's innovative approach to technological adoption. China is well-positioned to lead the way in the global telco industry for years to come, with a population eager to embrace the latest developments and a government committed to promoting digital transformation. As 5G continues to advance, it will serve as a driver for growth, innovation and improved quality of life, paving the way for a better and more connected future.