In this exclusive two-part series, Telecom Review shares a thorough analysis of the performance and trends in the Asia-Pacific region's telecommunications industry during the second quarter of 2023.

In this installment, we look at the telecoms revenue assessments using information from Twimbit's analysis titled "APAC Telcos Update Q2 2023."

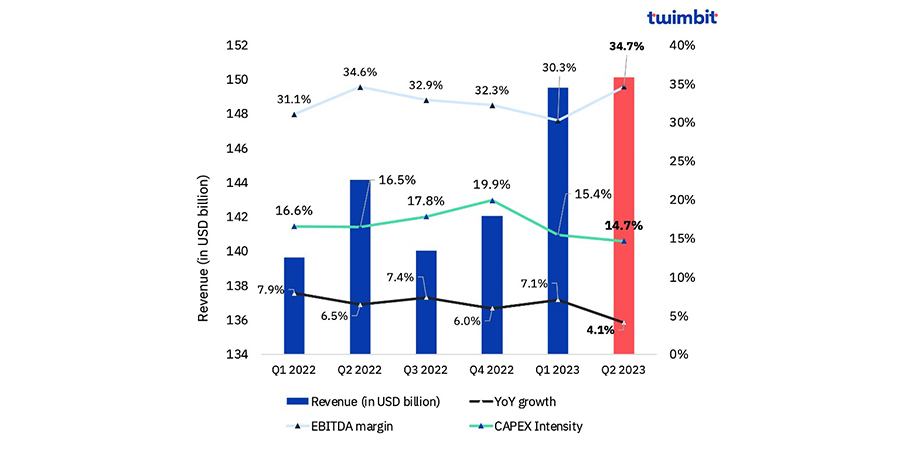

Exhibit 1: Overall Performance of APAC Telcos in Q2 2023

APAC telcos' overall performance, Q2 2023

Source: Twimbit Analysis

The second quarter of 2023 saw the lowest revenue growth rate among APAC telcos in the previous five quarters, at 4.1% year over year. Forty-two APAC telcos' combined revenue during this time period totaled $150.1 billion, an increase of $5.9 billion from Q2 2022. Six telcos saw double-digit growth, and 85% of the telcos saw improvements.

Read more: Global Telcos in Q1 2023: Revenue Performance

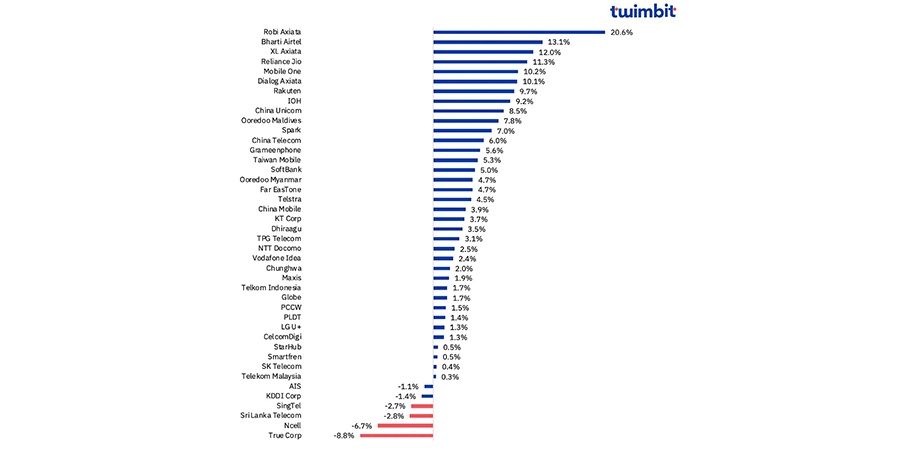

Exhibit 2: Revenue Trends for APAC Telcos (YoY Basis)

Revenue trends (% change) for APAC telcos (YoY basis), Q2 2023

Source: Twimbit Analysis

Robi Axiata

In Q2 2023, Robi Axiata reported the highest revenue growth of 20.6% (YoY basis), totaling BDT 25.4 billion (approximately $237.2 million), which was driven by an increase in data revenue.

An increase of 1.0 million new data subscribers brought the total to 43.1 million, representing a 25% YoY increase in data revenue.

Data revenue increased by 29.6% to BDT 9.9 billion ($92 million), accounting for 39% of total revenue, up from 36% the previous year. Additionally credited for this growth are subscriber and data ARPU growth.

Bharti Airtel

With 13.1% in Q2 2023, Bharti Airtel has the second-highest revenue growth, reaching INR 263.8 billion ($3.2 billion). It was solely due to the addition of 4G customers and improved realizations, increasing mobile revenues by 12.4%.

The expansion of the postpaid customer base and higher ARPU in the same period further boosted revenue growth. Compared to INR 183 (USD 2.2) in Q1 2023, ARPU increased to INR 200 (USD 2.4). The telco also increased its postpaid customer base by 0.8 million, bringing it to 40.4 million, and powered over 20 million connected devices.

XL Axiata

XL Axiata's revenue increased by 12%, reaching IDR 8.2 trillion ($551 million). The telco benefited from more XL Home subscribers, which rose by 50% to 154,000, and a penetration rate of 56% for convergence in Q2 2023.

By 2025, XL Axiata hopes to reach a 70% convergence penetration rate, and by the end of 2023, it plans to add 500,000 new XL Home subscribers.

Reliance Jio

Reliance Jio increased revenue by 11.3%, reaching INR 261.2 billion ($3.2 billion) on the back of 9.2 million net subscriber additions.

It introduced the JioBharat phone in Q2 2023 to advance the '2G-MUKT BHARAT' vision. It is also committed to investing in True5G with the goal of completing a pan-India 5G rollout by the end of 2023.

Read more: APAC Telcos Embrace Digital Era, Redefine Success With Non-Connectivity Revenues

True Corporation

True's revenue fell 8.8% to THB 49.1 billion ($142 million), owing primarily to a seasonal decline in product sales and a decrease in interconnection revenue following a one-time Q1 2023 litigation benefit.

Despite the overall revenue decline, service revenue increased by 1.1% due to market rationalization and convergence.

Ncell

Ncell revenue decreased by 6.7%, reaching NPR 9.7 billion ($74.3 million). The drop was primarily due to an 8.3% decrease in voice segment revenue, which was impacted by lower domestic interconnect rates.

Meanwhile, International Long Distance (ILD) revenue saw a healthy 5.6% increase despite the overall revenue decline.

Sri Lanka Telecom

Due to a significant decline of one million subscribers, Sri Lanka Telecom Group reported a 2.8% revenue decline in Q2 2023, totaling LKR 26.2 billion (roughly $84 million). This was also adversely affected by customer churn, a 90.3% YoY decrease in international transit revenue and delays in monetizing the fiber network.

Still, despite this, they observed expansion in the revenue streams from IPTV, businesses and broadband.

SingTel

SingTel's overall revenue decreased 2.7%, reaching SGD 3.5 billion ($2.6 billion). Despite a 2.7% YoY growth in mobile service, the overall revenue was negatively impacted by a 21% decline in Singtel TV revenue and a 7.1% decline in fixed voice revenue. In addition to that, Singtel Singapore also faced difficulties in the legacy carriage sector.

Currently, Singtel is actively promoting the adoption of 5G in businesses and the shift to the digital era. To increase revenue and cost synergies and maintain positive growth momentum, they are also integrating consumer and enterprise businesses.

Read More: Global Telcos in Q1 2023: ARPU Trends