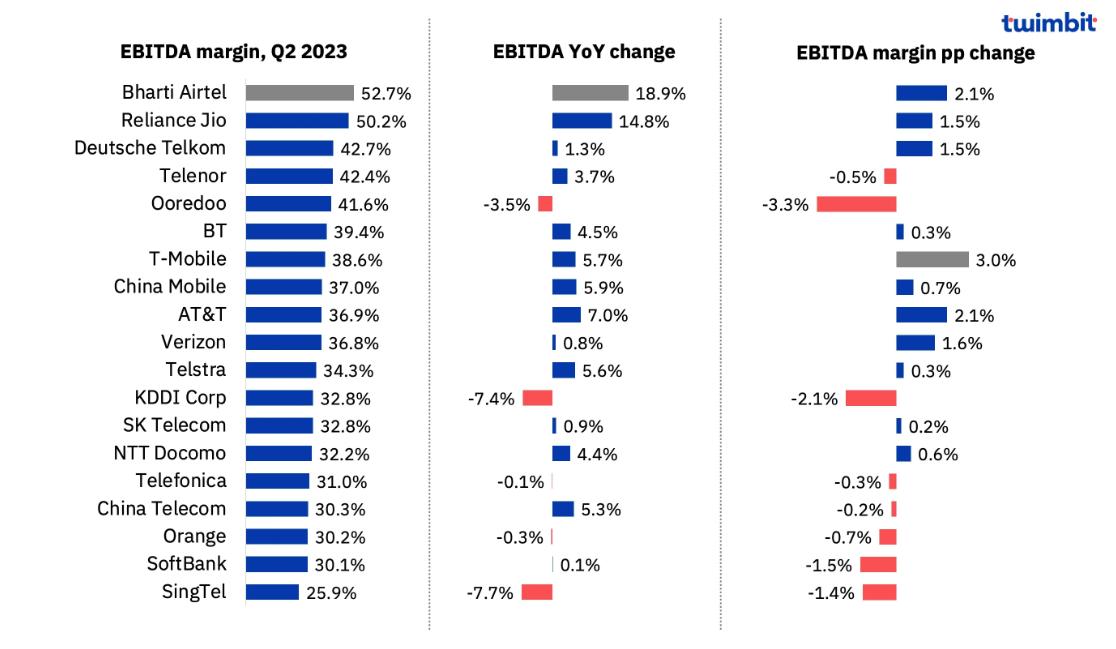

Twimbit recently analyzed the combined EBITDA margins of the top 20 global telecom companies. The report it produced focuses on the performance of Bharti Airtel, Deutsche Telekom, Ooredoo, Singtel, Telenor and Vodafone Group within this context.

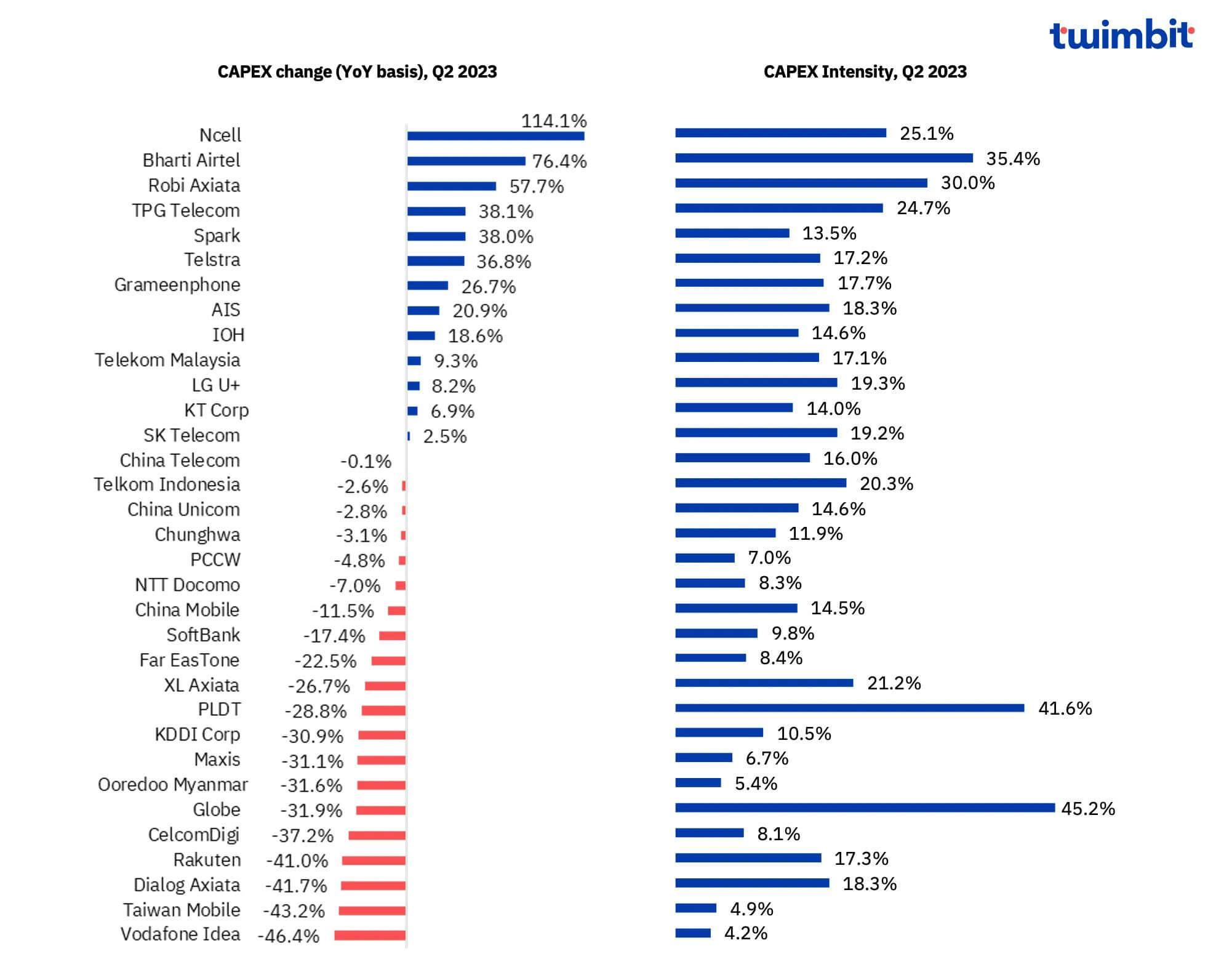

Furthermore, this Q2 of 2023 marked a significant milestone with the lowest CAPEX intensity observed over the past five quarters, signaling a downward trajectory in capital expenditure.

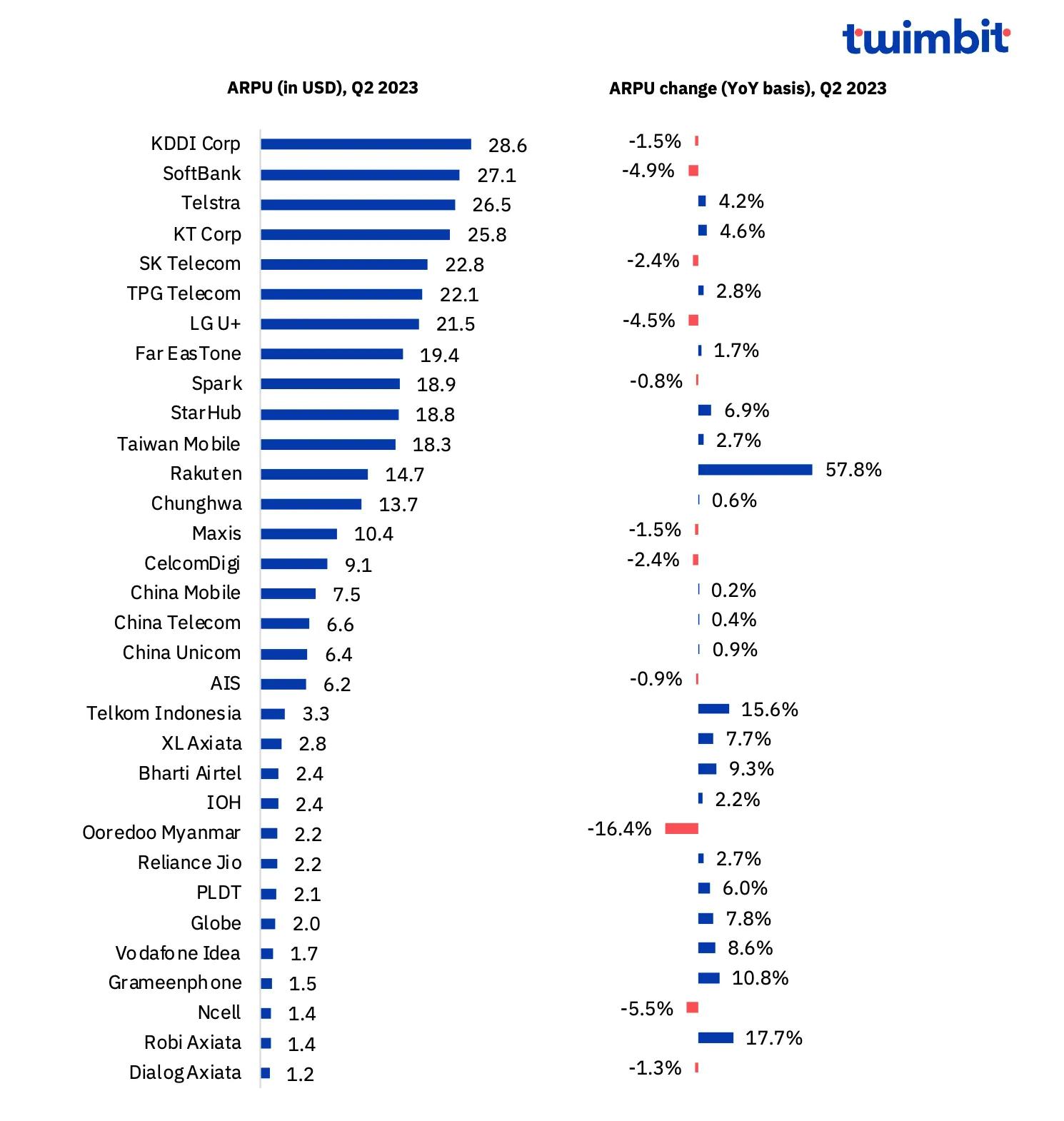

In addition, this quarter, data from the analysis indicated that approximately 50% of Asia-Pacific (APAC) telecom companies maintained stable Average Revenue Per User (ARPU) levels. These levels exhibited changes ranging from a -3% to a 3% year-on-year variance.

Telecom Review Asia is reporting the Twimbit findings, which show that these telecoms have experienced remarkable growth in their EBITDA margins, reaching an impressive 36.4% in Q2 of 2023, and the latest trends and developments in the telecom industry, including noteworthy findings related to CAPEX intensity and ARPU levels in the APAC region.

Telecom Titans Lead the Way

Among these telecom giants, two prominent Indian companies, Bharti Airtel and Reliance Jio, stood out with their robust EBITDA margins, both exceeding the 50% mark. Bharti Airtel Group reported a substantial 18.9% year-on-year increase in EBITDA, reaching INR 197.4 billion (US$2.4 billion) in Q2 2023. Additionally, their EBITDA margin improved by an impressive 212 basis points to 52.7%. This boost was attributed to their successful "War on Waste" cost optimization program, which effectively reduced operating expenses, propelling the EBITDA margin to new heights.

Reliance Jio followed suit, with its EBITDA margin rising from 48.7% in Q2 2022 to 50.2% in Q2 2023. This was supported by a 14.6% year-on-year increase in EBITDA, totaling INR 131.1 billion (US$1.6 billion). Despite a 9% year-on-year rise in total expenses, consistent subscriber additions and ARPU growth bolstered their operating revenue, leading to an improved EBITDA margin.

In Europe, Deutsche Telekom experienced a noteworthy EBITDA margin increase of 150 basis points, reaching 42.7%. This was primarily driven by heightened revenue in Germany and throughout the continent.

Source: Telco financials, Twimbit analysis

Challenges Amidst Declining EBITDA

However, not all stories were ones of growth and success. SingTel Group encountered a 7.7% year-on-year decline in EBITDA, amounting to SG$902 million (US$673.5 million) in Q2 2023. This decline was attributed to inflationary cost pressures, resulting in a 1.4% decrease in their EBITDA margin, down to 25.9%.

KDDI Corp. also faced a decline in EBITDA by 7.4% year-on-year in Q2 2023, primarily due to increased costs of sales and selling and general administrative expenses. Their operating revenue also decreased by 1.4% year-on-year, leading to a significant 10.3% decrease in operating income. Consequently, KDDI Corp. witnessed a 210 basis point decline in their EBITDA margin in Q2 2023, settling at 32.8%.

Within the Ooredoo Group, EBITDA experienced a decline in Q2 2023, with significant drops in EBITDA margins for their operations in Qatar and Oman, decreasing by 500 and 550 basis points, respectively. In Qatar, this decline was attributed to bad debt and competitive pressure, while Oman's EBITDA was impacted by a lower gross margin and higher operating expenses. An ongoing evaluation of the cost structure is underway to enhance operational efficiency.

Industry Dynamics

The EBITDA performance of the top 20 global telecom companies shows a varied picture of growth and challenges. Some companies have effectively improved their operations and achieved impressive EBITDA margin growth, while others are struggling with increasing expenses and market pressures.

These findings provide valuable information about the changing dynamics of the telecom industry, where financial performance is a key indicator of success. As the sector continues to evolve, it is essential for telecom leaders worldwide to stay informed about these trends and adjust their strategies accordingly.

Top Performers in APAC Telcos' CAPEX Investments

In the second quarter of 2023, APAC telcos allocated 14.7% of their revenue to CAPEX, marking a declining trend in CAPEX intensity over the past five quarters. Notably, the Indian telecom market stood out with expectations of increased spending, primarily driven by ongoing 5G developments.

Source: Telco financials, Twimbit analysis

Among the top performers, Ncell witnessed the most significant YoY CAPEX increase of 114%, primarily directed towards expanding and improving its service infrastructure, while Bharti Airtel reported a substantial 76.4% YoY increase in CAPEX, expanding its network coverage and investing in infrastructure. Meanwhile, Robi Axiata's CAPEX investments increased by 57.7% YoY, aimed at enhancing their 4G networks.

Double-Digit ARPU Growth in Q2

In the second quarter of 2023, a significant portion of APAC telcos witnessed the stabilization of their ARPU, with nearly 50% of these telecom companies reporting relatively steady ARPU levels, showing a marginal year-on-year change ranging from -3% to 3%. It's important to note that the ARPU values were calculated using the average currency conversion rate for April to June 2023, with changes in ARPU considered in a constant currency value framework for the same period.

The Indian telecom market continued to experience an upswing in ARPU levels, building upon the growth initiated in 2022.

Japan, on the other hand, anticipates a diminishing impact of tariff reductions and regulatory pressure on ARPU, with growth expected as early as next year. Japan maintains its status as the region's leader with the highest ARPU.

Source: Telco financials, Twimbit analysis

Impressively, four telcos achieved double-digit growth in ARPU: Rakuten (57.8%), Robi Axiata (17.7%), Telkom Indonesia (15.6%), and Grameenphone (10.8%). Indian operators Bharti Airtel (9.3%) and Vodafone Idea (8.6%) also showcased notable ARPU growth.

Rakuten attributed its ARPU surge to the SAIKYO Plan, launched in June 2023, which eliminated data limits for domestic roaming partners, providing unlimited high-speed data across the nationwide network. Moreover, their Option ARPU and Advertising services further bolstered ARPU, resulting in a remarkable 57.8% YoY increase in Q2 2023. Increased telecommunication fees for the mobile segment also contributed positively to ARPU levels.

Robi Axiata reported a robust 17.7% YoY growth in ARPU for Q2 2023, mainly attributed to a substantial 30% YoY increase in data revenue.

Telkom Indonesia's ARPU growth was a result of their successful strategy of industry pricing rationalization, which was reflected in higher payload and payload/data use, indicative of their customer base's quality.

Grameenphone achieved a remarkable 17.1% YoY growth in data revenues for Q2 2023, driven by a substantial 32.5% YoY increase in data usage, underscoring the evolving landscape of ARPU in the APAC region.

Read more: Global Telcos in Q1 2023: ARPU Trends

Read more: APAC Telcos Update Q2 2023: Revenue Growth and Challenges