By Mobilewalla CEO Anindya Datta

In today’s hyper-connected world, the demand for high-speed broadband is surging globally. The rise of 5G fixed wireless access (FWA), fiber expansions, and increased digital adoption have fueled an era of rapid transformation for broadband providers. However, with this growth comes a critical challenge: understanding market share, subscriber movement, and competitive positioning at a granular level to drive acquisition and retention strategies and sharpen operational planning.

Many broadband providers struggle with market share blind spots, where traditional datasets provide an aggregated view of penetration but fail to capture how users switch between providers, where competition is gaining ground, and where hidden growth opportunities exist. Without access to detailed, neighborhood-level intelligence, providers risk inefficient investments, missed revenue opportunities, and face losing customers to more data-driven competitors.

The Challenge: Traditional Market Intelligence Falls Short

For decades, broadband providers have relied on high-level market intelligence to devise expansion strategies, customer acquisition efforts, and network optimization; however, these insights often lack the necessary depth to identify key opportunities and threats.

Three core issues stemming from conventional market intelligence include:

- Lack of Granularity: Many datasets provide city- or region-level statistics but don’t break down which neighborhoods or household clusters are underserved, over-saturated, or in transition. This results in inefficient marketing spend and misaligned infrastructure investments.

- Subscriber Flow Blind Spots: Traditional reports don’t track real-time subscriber movement between communication service providers (CSPs), leaving providers unaware of churn risks and competitor gains. Without visibility into which households are switching and the reasons behind it, internet service providers (ISPs) struggle to implement effective retention strategies.

- One-Size-Fits-All Network Planning: Without clear insights into residential versus SMB (small- and medium-sized businesses) broadband demand, building types, or technology preferences (fiber, FWA, or mobile broadband), providers risk overbuilding in some areas while overlooking high-value opportunities in others.

To truly capitalize on broadband growth, providers need high-resolution market intelligence procured from data that is precise, granular, and actionable.

Why Granular Insights Are Critical for Broadband Providers

The telecom industry is evolving rapidly, and providers who fail to incorporate micro-market intelligence into their decision-making risk falling behind. Granular data enables providers to:

- Pinpoint Underserved Areas: Instead of broad regional views, internet service providers (ISPs) need to analyze broadband consumption and adoption at the neighborhood or block level to identify where demand outstrips supply.

- Optimize Expansion Strategies: By understanding market share trends and flow share patterns at micro-market levels, ISPs can prioritize investment in areas where they can capture high-value customers.

- Reduce Churn with Competitive Intelligence: Analyzing household-level subscriber movement between competitors helps ISPs understand who is switching, where they are going, and why, allowing for proactive retention measures.

- Tailor Offerings for Specific Audiences: By analyzing broadband demand based on residential versus SMB usage, fiber versus wireless preferences, and urban versus rural areas, providers can develop targeted service plans that better meet customer needs.

Market Flow: Powering Data-Driven Broadband Growth

Addressing these challenges requires a next-generation solution.

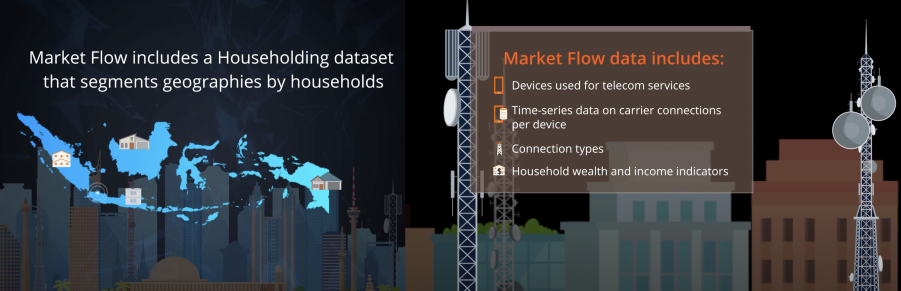

Market Flow from Mobilewalla equips broadband providers with detailed, household-level data covering market share, subscriber flow movement, and competitive insights.

Market Flow offers:

- Granular Market Share Insights: Get precise market penetration and share data at the country, city, neighborhood, block, or even individual household level.

- Subscriber Movement Tracking: Understand which customers are leaving, where they are going, and the drivers behind these shifts.

- Competitive Benchmarking: See how your broadband penetration compares to competitors in specific geographies, identifying opportunities to drive higher market share.

- Technology Adoption Analysis: Determine the distribution of fiber, mobile broadband, and FWA adoption to align service expansion with market demand.

- SMB Versus Residential Identification: Differentiate business and residential broadband demand to create targeted acquisition and retention campaigns.

By leveraging these insights, broadband providers can make smarter investment decisions, increase their market share, and reduce customer churn.

Real-World Application: Lessons from Indonesia’s Broadband Expansion

A prime example demonstrating the need for granular broadband intelligence is Indonesia’s fast-growing fixed broadband market. With over 98 cities and a rapidly expanding middle class, the country presents massive opportunities, yet also navigates complex challenges, such as network deployment and competitive positioning.

Market Flow is enabling broadband providers in Indonesia to:

- Identify high-growth neighborhoods with strong demand for fiber and FWA services.

- Track subscriber movement between competing providers to mitigate churn risk.

- Differentiate network strategies for urban and suburban communities, improving service allocation.

The lessons from Indonesia can be applied globally. Regardless of whether they are based in the U.S., Southeast Asia, or Europe,

broadband providers must use data-driven decision-making to outsmart competitors and capture new growth.

Final Thoughts: The Future of Broadband Intelligence

The broadband industry is at a turning point. Providers who rely on outdated, high-level market intelligence will struggle to compete in an environment where micro-market dynamics drive success. To stay ahead, ISPs must embrace granular insights that illuminate market share blind spots and provide a clearer understanding of subscriber movement, competitive threats, and high-value expansion zones.

Mobilewalla is leading this transformation, helping providers see beyond broad trends and dive deep into the real market forces shaping broadband adoption.

Contact Mobilewalla to learn how Market Flow can help your broadband business thrive and download Mobilewalla's whitepaper for a detailed look at unlocking new growth opportunities.