Japan's mobile telecommunications pioneer, NTT Docomo, reported an increase of about 4% in revenues and net profit in the first half, showing good conditions despite competition.

However, it has revised downwards its annual net income forecast because of taxes that will exceed initial expectations.

From April till September, the net profit amounted to 407.7 billion yen (3.1 billion euros at the current price) for a turnover of 2.389 billion yen. Its operating profit was 9% over one year.

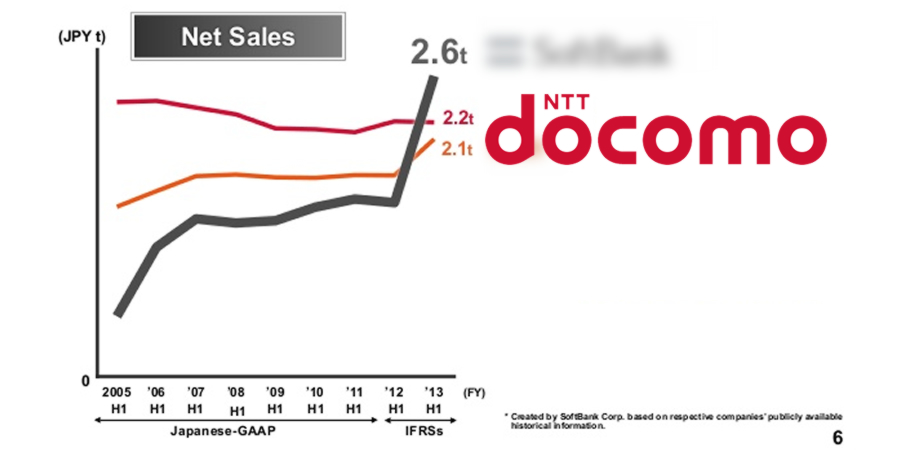

NTT Docomo resists well to the endless fires of its rivals KDDI and SoftBank, or rather it fires back with new offers and promotions and an extension of its services.

In recent months, it has focused on fiber-optic “mobile + fixed” coupled formulas for the whole family, which caught the attention of customers. The increase in fixed-bid subscriptions (from $4.18 million to $5.33 million in one year) increased revenues, as it also increased revenues from mobile payments and online commerce through Docomo.

At the end of September, NTT Docomo had acquired 77.05 million subscribers to its mobile services (for a population of 127 million), a rise of 2% year-on-year thanks to the multi-equipment trend: smartphone owners are also tending to buy a tablet or a pocket WIFI terminal.

For the current fiscal year ending in March 2019, NTT Docomo has revised its forecasts, now defined by the IFRS standard, making the results impossible to compare with the ones for 2017-2018. The group now expects an increase in the turnover of 2.1% to reach 4.860 billion yen and a net profit of 670 billion yen (-15.3%), victim of higher tax burdens.

NTT Docomo also continues to invest directly in 5G hoping to launch it before the 2020 Olympic Games. It plans to inject 1,000 billion yen (7.6 billion euros) in the required infrastructures between 2019 and 2023.

NTT Docomo’s administration also warned that as of next year, it will propose a new pricing model with lower prices that should reduce by 20 to 40% the customers’ bill for mobile telecommunications.

This initiative, which responds to pressing government demands, is likely to force others (KDDI, SoftBank and Rakuten, who’s building its own cellular network) to keep up.