The fixed communications services market in Indonesia is expected to generate US$1.7 billion in revenue by 2027, growing at a compound annual growth rate (CAGR) of 7.6% from US$1.2 billion in 2022.

This is primarily caused by the rapid uptake of fixed broadband services, according to GlobalData's Indonesia Fixed Communication Forecast (Q1 2023). It predicts that as users continue to switch to mobile and internet-based communication services, circuit-switched subscriptions will decline at a CAGR of -2.6% over the years.

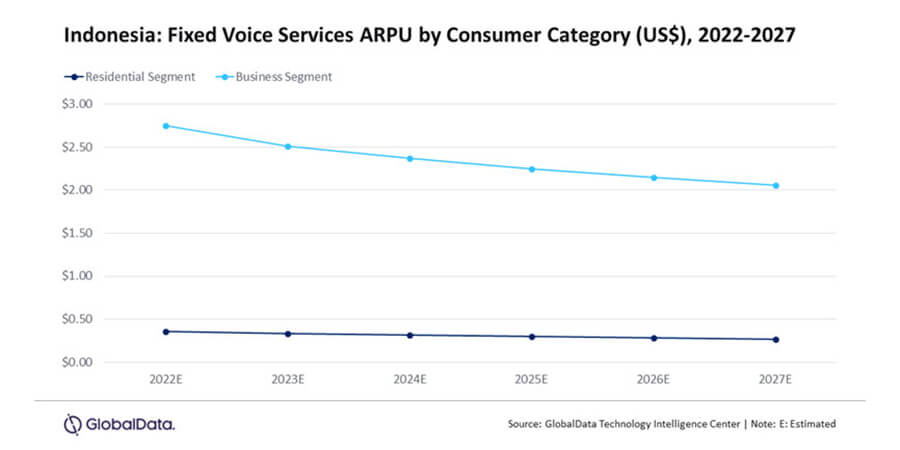

Between 2022 and 2027, it is anticipated that the overall fixed voice service ARPU levels in both the residential and business categories will decrease from US$0.36 to US$0.27 and US$2.75 to US$2.05, respectively. This will result in a significant decline in total fixed voice service revenues.

On the other hand, fixed broadband accounts will expand at a strong CAGR of 10.6% throughout the projected period, driven by the growing uptake of high-speed fiber-optic broadband services. By the end of 2027, fiber-to-home/business (FTTH/B) lines will make up 93% of all fixed broadband accounts in the nation. This is due to increased demand for high-speed Internet services and the continued growth of the country's fiber-optic networks.

Telecom Analyst of GlobalData Pradeepthi Kantipudi stated that Cable and DSL's share in the overall fixed broadband lines will decline to reach 5.2% and 1.8%, respectively, by the end of the forecast period.

“Telkom Indonesia is expected to lead both fixed voice and broadband service segments by subscriptions over the forecast period 2022-2027,” he explained.

He also further explained that Telkom Indonesia's strong footprint in the traditional circuit switched segment as well as in the VoIP segment will support its leadership position in the fixed voice services market.

“The operator’s strong position in the fixed broadband segment can be attributed to the ongoing modernization of its fixed infrastructure with fiber-optic networks across the nation,” Kantipudi concluded.