Telecom Review has successfully concluded its latest webinar titled "Increased Data Boosting Wholesale Capacity," which gathered industry experts to discuss the importance of wholesale capacity in enhancing international telecommunications infrastructure projects and other services.

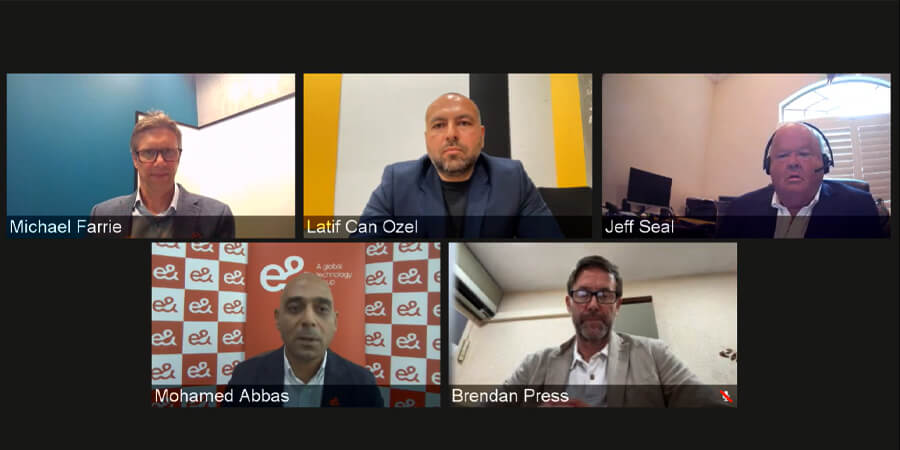

Jeff Seal, Editor-in-Chief and Managing Partner of Telecom Review North America, was the moderator of the panel, which featured executive panelists, including Brendan Press, Chief Commercial Officer, GBI; Michael Farrie, Director, Partner Solutions Groups, Verizon; Latif Ozel, International Section Director, IQ; and Mohamed Abbas, Director, Hyperscalers Businesses, e&.

Wholesale’s Obstacles

Seal opened the discussion by addressing the current obstacles hindering the acceleration of wholesale growth in terms of regulations, bandwidth capacity and latency. Brendan Press of GBI acknowledged industry growth driven by leading players serving consumers and businesses. However, new infrastructure is needed to sustain this growth. While there is investment, delays and challenges in securing resources and forming alliances persist. Press emphasized coordination among markets and regulatory developments.

Additionally, Latif Ozel of IQ highlighted the various obstacles hindering the acceleration of wholesale growth, particularly in terms of regulations, bandwidth capacity and latency. He emphasized that regulatory frameworks and policies differ across regions due to variations in history, politics, the economy and social status. This lack of collaboration and shared vision creates complexity and barriers for wholesale providers to cooperate effectively and ensure efficient business operations. To address this, Ozel proposed the standardization of regulatory frameworks based on generic parameters such as culture, population, geography and economic capabilities.

Michael Farrie of Verizon emphasized the impact of evolving technology on the emergence of various services and the subsequent increase in data volume. However, this technological advancement also gives rise to an increase in threats, necessitating compliance with network standards and regulations. The complexity of regulation and licensing requirements poses a significant and costly challenge, both in terms of time and intellectual navigation. The competitive landscape, especially with the rapid growth of hyperscale entities, adds an element of uncertainty to determining the necessary network capacity and ensuring a satisfactory return on investment. The pricing must align with consumer expectations. Moreover, environmental compliance, rising energy costs, inflation challenges and supply chain issues further complicate the steel structures.

Mohamed Abbas of e& also answered this question by highlighting the challenges faced by telecom and wholesale providers in navigating complex regulatory frameworks across countries. Compliance with regulations can be costly and time-consuming. The UAE's collaboration between the regulatory authority and telecom operators has positioned it as a tech hub. Wholesale providers must address bandwidth challenges and invest in infrastructure upgrades. Abbas emphasized reducing latency by establishing terrestrial routes and localizing content. e& has been a pioneer in achieving 73% traffic localization in the UAE.

Issues in Establishing a Growing Network Environment

Moving on to the next topic, Abbas discussed the expansion of digital infrastructure, including 5G networks, fiber optic networks and cloud computing. The UAE leads in FTTH penetration and has made significant progress in network technology, reducing latency and improving performance. e& hosts major hyperscalers, reducing the need for submarine cables. Although there's more work to be done in areas with limited connectivity, the overall trend is towards a faster and more reliable digital environment.

Moreover, Ozel added the importance of submarine cables for global connectivity but acknowledged challenges like operating costs and the need for low latency. Terrestrial alternatives provide diversification, redundancy and uninterrupted connectivity. They offer simplified installations, repairs and low-latency connections, enhancing data transmission speeds. Consortiums play a crucial role in spreading financial risk and leveraging technical knowledge. IQ Network's Ebro Transits project reduces delays and offers a promising alternative for improved connectivity.

In addition, Farrie highlighted the increasing global demand for connectivity, comparing it to a runaway train. Different regions experience varying growth rates, with Africa showing potential. Content providers are building their own networks in the cloud-based environment, creating opportunities for carriers to expand the ecosystem. The deployment of submarine cables will bring a significant amount of capacity online. However, land-based connectivity poses challenges, and there is uncertainty about the need for additional infrastructure.

Press emphasized the importance of diversity in connectivity. GBI, as an infrastructure provider, is investing in new routes to offer alternatives and reduce dependency on specific paths. This allows for low-latency north and south route solutions, ensuring uninterrupted services. The focus is on providing 100% service continuity and cost-competitive hosting capabilities. Press sees this approach as the core of their business, ensuring innovation and meeting customer needs effectively.

Innovation as a Growth Engine

On this topic, Abbas said that the wholesale industry overall is constantly evolving and that new digital solutions and business models are emerging to keep up with the changing market demands. "We have seen that some of the latest trends and the launch of the new digital solutions and business models in the wholesale industry include some of the new digital business services that are not limited to that, including e-commerce platforms to reach a wider audience and streamline their operations. This allows customers to easily place orders and track their deliveries online. We were the first regional operator to offer a telecom and e-commerce platform to help regional and domestic merchants and customers in their daily transactions."

Ozel noted that the IoT was continually driving innovation in the ICT industry. He said that the challenges of deploying IoT solutions relating to standardization protocols, device installation, etc. have been minimized over the years. "But today, most of these challenges have been tackled, and the capacity required for a device is usually not substantial. Considering millions and even billions of devices, it can generate huge amounts of data," he explained. With this, he shared some stats from July 2023 that showed approximately 15 billion connected IoT devices worldwide, with the figure expected to almost double to 30 billion by 2030, with the top five leading countries being China at 5.2 billion, the US at 3 billion, India at 2 billion, Japan at 1.8 billion and Germany at 1.6 billion.

Farrie agreed with others that innovation in the wholesale space was critical and that the need to evolve the revenue line in essentially legacy-based operations was top of the agenda. However, he pointed out that there is a risk in "trying to be all things to all customers." Drawing from the vast experience of Verizon, Farrie said that fixed wireless access, video conferencing and automation were key to delivering the goods in a new business model set up for the wholesale industry. He explored at length the value of wireless connections in sectors such as industrial, health and education, among others, through platforms like BlueJeans video conferencing solutions.

Press explained that GBI is focused on its core business of building infrastructure. "If we don't provide the platform, the capacity, the continuity of service and the routine for latency and hosting, our business will take a hit. We are entering into a great partnership with Meta, providing localized services with low latency not just in Qatar but across the Middle East region. We are developing a new route into Europe that allows new services to be accessible, so people playing games in the region don't have to access content outside the region and can have a better experience. We believe the core business is ensuring the ongoing and continual processes in infrastructure, especially in a region where infrastructure is built, and ensuring that we can be a trusted partner so that other players that deliver top-notch services can see the benefits.”

Importance of New and Geographically Redundant Data Centers

Farrie talked about the demand to build more data centers and how important it is. He stated: “We sort of think about some of the key industry themes like virtualization, security and sustainability that really influence the industry; we see an exponential increase in cloud applications from big enterprises right down to small businesses. So all of those applications go off to the cloud, and that would create more storage data that is basically implemented in a secure environment. So to that extent, there will always be a need for more data centers."

As for Ozel, he agreed with his colleagues on bringing more data centers because they are critical infrastructure for storing, processing and delivering digital services. They provide the necessary computing power, storage capacity and network connectivity required for businesses to operate, and data centers enable businesses to enhance their digital capabilities, improve data security and achieve high availability for their services.

Abbas believes that the implementation, expansion and development of the data center business are very important and are key to any telecom provider's growth, specifically on the wholesale front. The data center business is a massive part of Verizon's business, noted Farrie. He would add that it's the same on e&’s end as well. The data center business is a massive part of it, and that's why they have extended their data center footprint and continue to do so every day, which is aligned with their leadership's long-term vision of creating a digitally empowered region within the UAE through innovation and digitization.

As for Press, it's very important that they also ensure neutrality from the telecoms perspective, because data centers are built without neutrality in single-operator service and because that's been the only way Press thinks it has happened. Press stated his belief that the growth for all players mentioned earlier — the overall wholesale market, as an example — is the same for data centers. He feels those who are investing in service operations or center providers need that neutrality. “We've seen that stuff go back to regulations and discussions of where the market is in terms of the provider.”

Upcoming ICT Projects

Moving on to the upcoming ICT projects for each company and in each country, Abbas mentioned that every company should welcomely initiate new projects: "We are very excited about the opportunities ahead and about the impact we can make in the lives of our customers. We have made significant strides in artificial intelligence, and we are aiming to deliver a groundbreaking and personalized experience.”

Several projects were planned by Verizon as well. With this, Farrie detailed: "We’ve built our network, known as IEN, and we are doing a lot in autonomous retail."

Ozel highlighted that IQ is working on many ICT projects, like building two centers in Iraq. They are greatly focusing on green initiatives, implementing Solar Panels, for example.

For Press, the most important thing is how the existing network evolves. "Connection with new cable is the essence of the core of our business". He underscored that partnerships are critical to GBI.

Finally, regarding a poll question asking what are "Suppliers’ Main Challenges," 14% of the audience voted for "Develop Innovative Pricing Offers," with 36% choosing "Reduce Time to Delivery," 7% picking "Improve Service Resilience and Recovery," and a winning 43% choosing "Provide Consistent and Powerful Portals and B2B Interfaces.”