Leading data and analytics company, GlobalData, has forecasted Taiwan's mobile service revenue to expand at a compound annual growth rate (CAGR) of 5.3% from $6.2 billion in 2023 to $8.0 billion in 2028, fueled by increasing mobile data adoption.

As per the Taiwan mobile broadband forecast by GlobalData (Q3 2023), there is an anticipated decline in mobile voice service revenue. It is expected to contract at a compound annual growth rate (CAGR) of 1.3% from 2023 to 2028. This decline is attributed to the decreasing Average Revenue Per User (ARPU) for voice services, which is influenced by users' inclination toward OTT/ internet-based communication platforms.

In contrast, mobile data service revenue will grow at a CAGR of 7.3% over the same time due to the introduction of higher ARPU-5G services.

The Impact of Online Entertainment on Monthly Data Consumption

The rising consumption of high-bandwidth online entertainment and social media content on smartphones is expected to boost monthly mobile data usage from 31 GB in 2023 to 47.3 GB in 2028.

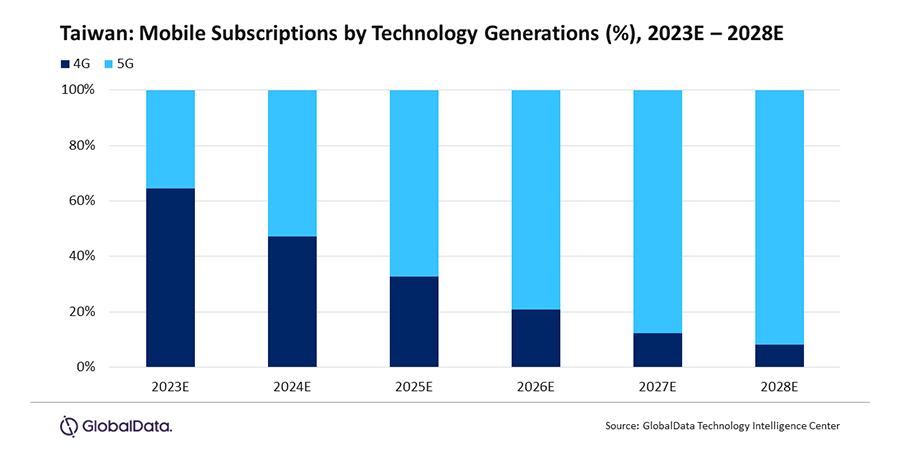

Kantipudi Pradeepthi, telecom analyst at GlobalData, explained, “4G services will account for a majority share of total mobile subscriptions in 2023. However, 5G subscriptions will surpass that of 4G in 2024 and go on to account for over 90% of the total mobile subscriptions share in 2028, mainly due to increasing availability and adoption of 5G-enabled smartphones and the ongoing 5G network expansions by operators.”

Taiwan’s Mobile Service Market Split

As of 2023, Chunghwa dominates Taiwan's mobile services market, followed by Taiwan Mobile and Far EasTone. Due to its 5G network expansion and focus on accelerating 5G service adoption by offering flexible pricing plans and diversified mobile value-added services like music, movie, TV and cloud gaming, Chunghwa is expected to lead through 2028.