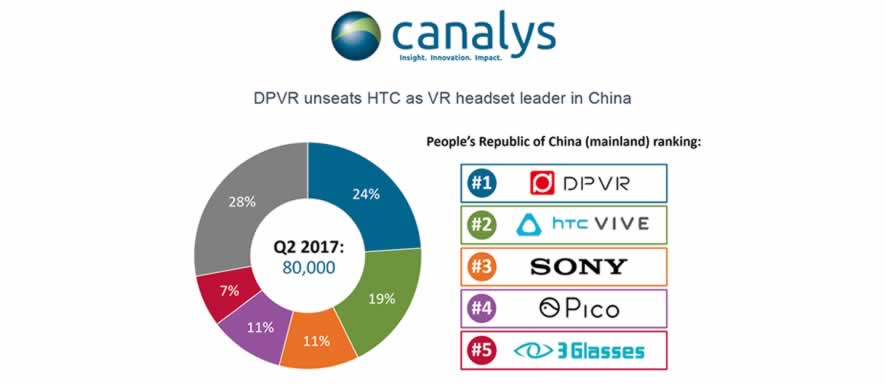

Chinese firm DPVR overtook HTC as the top virtual reality (VR) headset vendor in China in Q2 2017, according to Canalys research, shipping 18,000 headsets, resulting in a 30 percent quarter-on-quarter increase. HTC, whose only product is the HTC Vive basic headset, suffered a 6 percent sequential decline, shipping 14,000 units.

Sony took third place in China, according to the research, shipping 9,000 PlayStation VR headsets. According to Canalys estimates, the overall VR headset market in China grew 25 percent quarter-on-quarter to reach 80,000 units. Notable vendors, including Pico, 3Glasses and Hypereal, contributed to growth with new product releases.

DPVR ships a variety of VR products, with a strong focus on standalone smart VR headsets, which accounted for 60 percent of its total shipments in Q2. The company benefited from a better product mix, according to Canalys, with the addition of the newly-released E3, a basic VR headset that tethers to a PC.

“The E3’s biggest selling point is its competitive price,” said Canalys Analyst Jason Low. “By dropping the barrier to entry, businesses are now investing more in VR. DPVR is winning contracts from B2B partners, including media content and service providers looking to deliver VR content to customers at home.”

DPVR shipped 7,000 E3s in Q2 2017, though it still trailed behind HTC and Sony in the basic VR headset segment.

In the second half of the year, Canalys expects the market to move toward smart VR headsets. HTC announced the recruitment of developers for its upcoming smart VR headset during ChinaJoy 2017, an entertainment expo held in Shanghai in July.

“HTC saw the need to quickly launch a standalone headset specifically for the Chinese market to follow the trend early,” said Low. But even as HTC drops the selling price, the current Vive system poses many challenges for both consumer and business adoption due to its complexity and the need for VR-ready PCs. “HTC will regain its top position in China if it produces an appealing standalone headset that is affordable yet capable of providing new use cases for both businesses and consumers.”

China’s consumer market remains challenging, especially for basic VR headsets that need an additional external computing device, according to Canalys. But Chinese vendors have identified opportunities that HTC and Sony missed.

“Hypereal, a newcomer to the industry, released the Pano, an affordable headset suitable for VR gaming on the PC, to fill the void caused by the absence of Oculus in China,” said Canalys Research Analyst Mo Jia. “Vendors must lower prices while improving the user experience and content to drive growth and adoption in the consumer market. Pico demonstrated that it is possible to produce an appealing standalone headset while offering a decent VR experience for under CNY 2,000 (US$300).”

Canalys estimates that worldwide VR headset shipments reached 800,000 units in Q2 2017, with China accounting for 10 percent of the market.