Sony Corporation announced its highest ever third quarter operating profits for the fiscal year ending 31 December 2017, posting a nearly four-fold increase of 11.5 per cent year-on-year as compared to the same quarter of the previous fiscal year.

The company’s sales and operating revenue of US$23.65 billion (¥2.67 trillion) were spurred by solid growth and an impressive performance in the Home Entertainment & Sound (HE&S) and Game and Network Services (G&NS) segments. Sony’s consolidated operating income was US$3.1 billion (¥350.8 billion), which is approximately 3.8 times higher than the same quarter of the previous fiscal year.

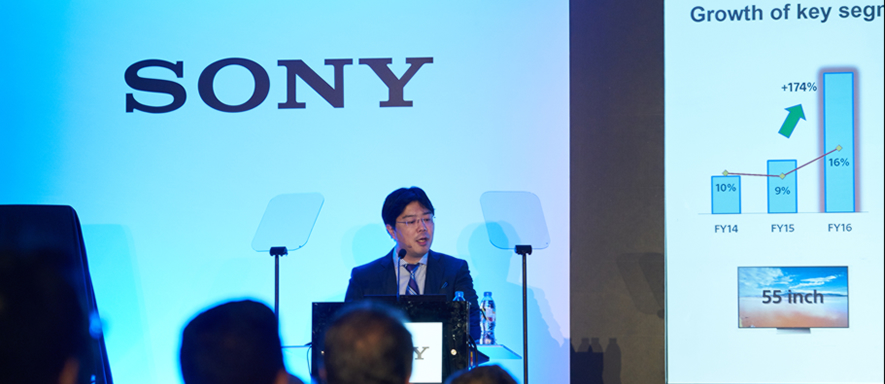

The robust improvement in the operating results of the G&NS, semiconductors, financial services and HE&S segments contributed highly to the Q3 operating income. During this period, HE&S’s operating income increased 20 per cent year-on-year to US$408.8 million (¥46.2 billion) while sales grew by 76 per cent year-on-year to US$3.8 billion (¥429.8 billion).

The increase in sales and operating income was primarily due to a shift towards high value-added models, particularly 4K televisions, and the positive impact of foreign exchange rates. Sony has also upwardly revised its forecast for operating income by US$35.4 million (¥4 billion) to US$708 million (¥80 billion) primarily due to an improved mix of audio and video products.

“Throughout the fiscal year of 2017, we have aligned our Middle East and Africa regional growth strategy with Sony’s global strategy by re-engineering our operations and evolving priorities through a united front with our channel partners in the retail space. Along with the positive consolidated financial results, we are on track to achieving our forecast of 20 per cent business growth across the region,” said Taro Kimura, Managing Director, Sony Middle East & Africa.

Meanwhile, sales and operating revenues of the Imaging Products & Solutions (IP&S) segment climbed eight per cent year-on-year to US$1.6 billion (¥181.1 billion) and operating income increased by US$43.3 million (¥4.9 billion) to US$230 million (¥26 billion). Improvement in the product mix, reflecting a shift to high value-added models and favorable foreign currency movements also acted as a catalyst for the IP&S segment.