India's ambitious efforts to become a leading smartphone manufacturer has stalled due to a combination of factors - which range from a rigid tax regime, to a lack of skilled labor which is required for the country to become a manufacturing force.

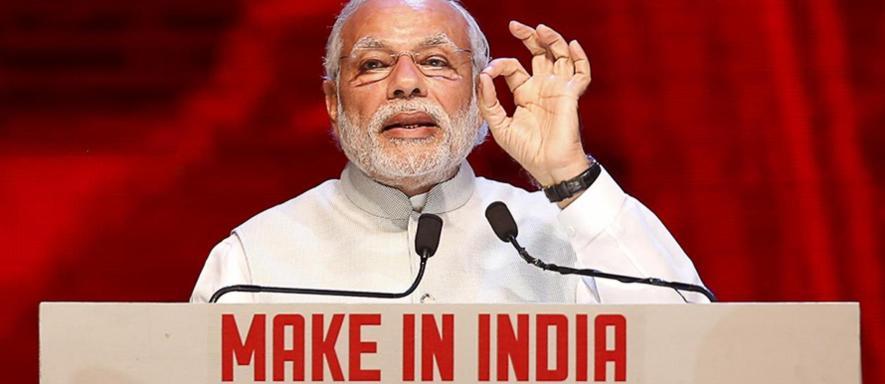

India's Prime Minister has embarked on a series of progressive programs and initiatives since taking office – and he has championed the country's efforts to become 'smart'. In addition to this, he has also publicly backed the 'Make in India' campaign which has been designed to make the country a manufacturing force once again, like it was historically, in a bid to both overhaul its sluggish economy and create millions of new jobs.

One of the most notable success stories of this initiative led by Prime Minister Modi was its deal with US smartphone giants Apple. However, three years on from when the program was initially launched, India has struggled to establish itself as thus far only succeeded in assembling phones from imported components.

India is recognized as one of the world's fastest growing smartphone markets, but whilst manufacturers such as iPhone maker Foxconn Technology have set up base in the country – almost none of the higher value chip sets are produced domestically.

Financial analysts have set India's draconian tax regime has caused a number of manufacturing projects to stall, including Foxconn's plan to build an electronics plant that would've created up to 50,000 jobs in the state of Maharashtra. According to tech research firm Counterpoint, while phones are assembled domestically because of taxes on imported phones, locally made content in those phones is usually restricted to headphones and chargers - about 5 percent of a device's cost.

"Rather than feeling that India is a place where I should be making mobile phones, it's more like this is the place I need to(assemble) phones because there is lower duty if I import components and assemble here," a senior executive with a Chinese smartphone maker said.

In addition to tax woes, other fiscal experts have highlighted India's lack of skilled engineers as being a huge problem, and the country's track record of becoming embroiled in a number of high-profile tax disputes with foreign companies such as Nokia and Apple have also put off a number of potential foreign investors. As a result of this dispute, the Finnish telecommunications colossus eventually suspended its mobile handset production at a facility which was located in the Southern part of India.

"The Nokia escapade is in people's memory when they try to come here," a second industry source told Reuters at the first Indian Mobile Congress in capital New Delhi, which ended on Friday. India's nationwide sales tax (GST), which kicked in this year to replace a string of different levies, is also fraught with its own challenges, such as a lengthy tax-refund process that delays payments to suppliers, the source added.