With the growth in mobile and fixed broadband segments, Vietnam’s total telecom services revenue is projected to increase at a compound annual growth rate (CAGR) of 4.4% from 2022 to 2027, as forecasted by GlobalData, a leading data and analytics company.

GlobalData’s Vietnam Telecom Operators Country Intelligence Report reveals that mobile voice service revenue will decline during the forecast period, due to a steady drop in mobile voice service ARPU, with users increasingly shifting to OTT communication platforms.

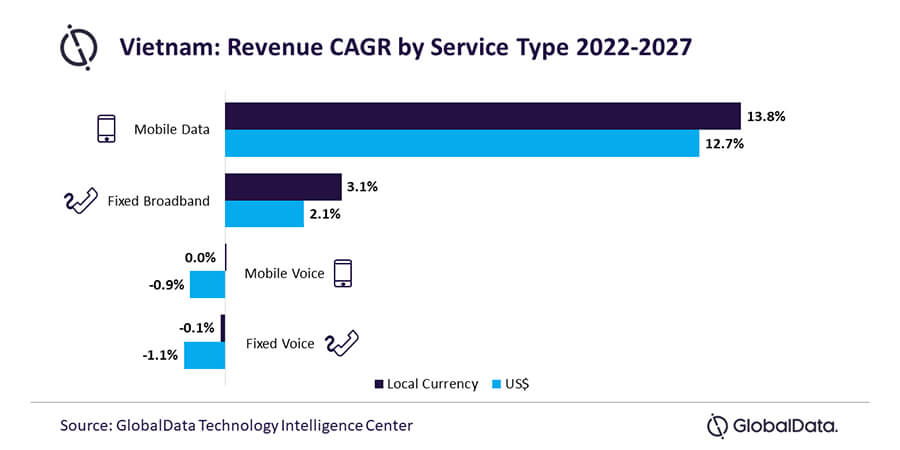

On the other hand, mobile data service revenue is expected to increase at a CAGR of 13.5% over the forecast period due to the continued rise in mobile internet users, particularly on 4G networks.

The scheduled launch of 5G services in 2023 and the subsequent rise in their adoption over the forecast period are expected to boost mobile data service ARPU levels and drive revenue growth in the segment.

Aasif Iqbal, telecom analyst at GlobalData, says: “4G services accounted for the largest share of the total mobile subscriptions in 2022 and will continue to do so through to 2027. Though from a low subscriber base, 5G service adoption is expected to gain pace over the forecast period as it becomes more widely available, with telcos and the government focusing on 5G network expansion. For instance, the government of Vietnam plans to achieve nationwide 5G coverage by 2030.”

However, fixed voice service revenue is expected to decline over the forecast period due to losses in circuit-switched subscriptions and declining fixed voice ARPU. Fixed broadband service revenue, on the other hand, will grow at a CAGR of 4.5% over the 2022-2027 period, mainly led by fiber broadband services.

The government of Vietnam is planning to expand fiber internet infrastructure to 80% of households and 100% of communities by the end of 2025. This development, together with the growing demand for higher-speed broadband connectivity, will support the increase in fiber broadband service adoption through 2027.

Iqbal concludes: “Viettel led the mobile services segment in terms of subscriptions in 2022 and will continue to hold the top position throughout the forecast period, thanks to its strong focus on 4G/5G network expansions. VNPT topped the fixed voice and fixed broadband segments. In fixed broadband segment, VNPT will maintain its leadership through to 2027, supported by its strong position in the FTTH segment and discounted multiplay service bundles combining fixed broadband, mobile and pay-TV services.”