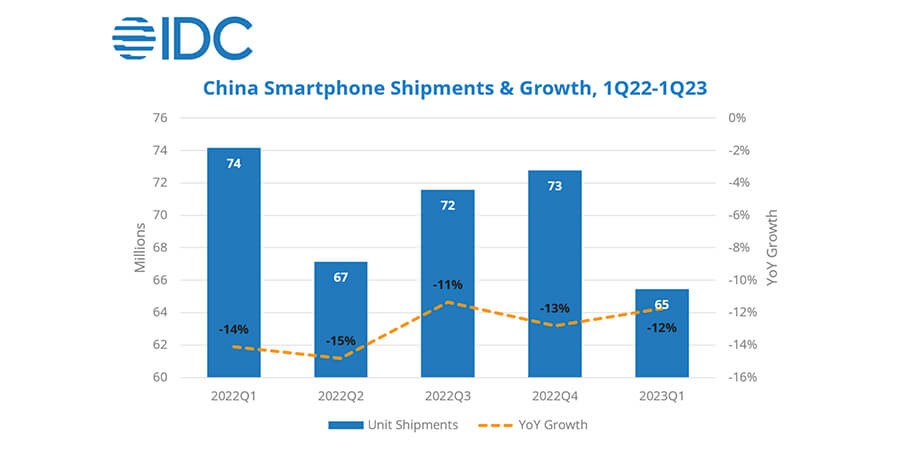

In the first quarter of this year, China shipped 65.4 million smartphones, down 11.8% year-on-year (YoY), as published in the IDC Worldwide Quarterly Mobile Phone Tracker. The market continued its double-digit decline since the first quarter of 2022, even though the zero-COVID policy ended in December.

Gloomy consumer confidence continued to constrain the demand for smartphones, while wealthier consumers shifted their spending to areas like leisure and services. On the supply side, more RAM and storage are lengthening replacement cycles.

OPPO claimed the largest market share at 19.6% with its sub-brand, OnePlus. OPPO’s foldable products, the Find N2 and Find N2 Flip, as well as its flagship Find X6 series, helped the brand better shape its high-end image, while OnePlus’s more-than-fourfold YoY growth also supported the vendor’s performance. With a 17.6% market share, Apple dropped to the second position, though it launched a rare price discount in February to stimulate demand for its iPhone 14 Pro and Pro Max. In third place is vivo, with a 17.3% market share. All three brands recorded negative growth, at -8.8%, -7.0% and -14.9%, respectively.

“As expected, 1Q23 was not a good start as consumers became more budget conscious or shifted to social activities like dining and traveling,” said Will Wong, senior research manager for client devices at IDC Asia/Pacific. “Nevertheless, an aggressive pricing strategy is not the sole solution. Introducing products like foldables, which provides value by impressing friends or enhancing social status for some users, will be equally important.”